THE Nigerian Breweries has announced a price increase on all their products effective 10th August 2023, amid the current economic challenges in the country.

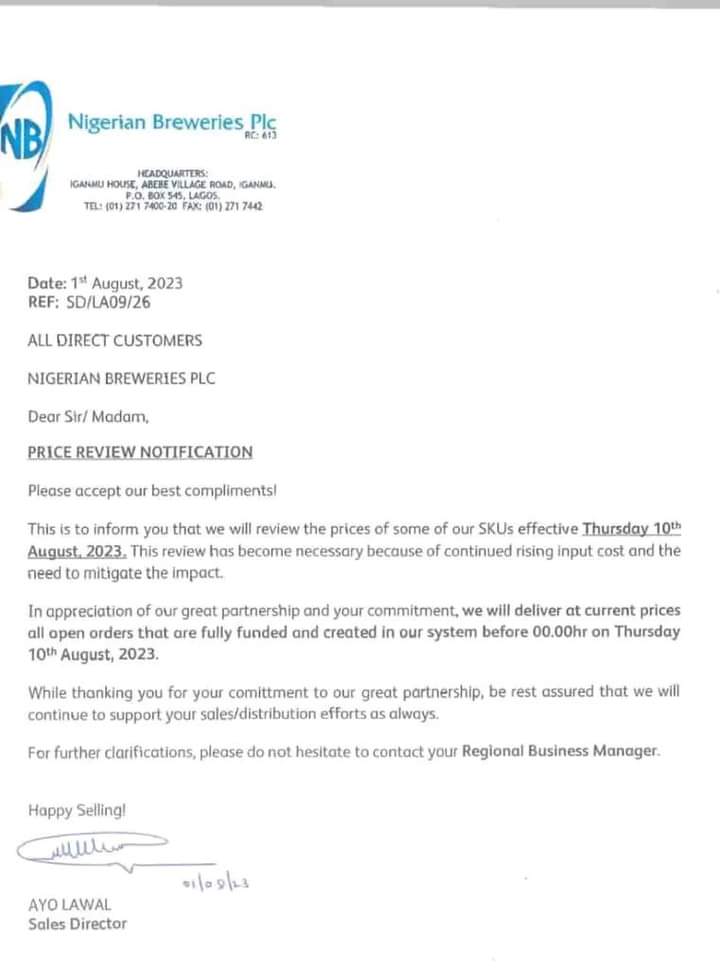

This was disclosed in a letter dated 1st August 2023 and shared online.

In the letter, it was stated that the need to review prices was because of the continued rise in input costs and the necessity to mitigate its impact.

“This s to inform you that we will review the prices of some of our SKUs (Stock Keeping Units) effective Thursday 10th August 2023. This review has become necessary because of continued rising input costs and the need to mitigate the impact,” the letter signed by Ayo Lawal, the company’s sales director said.

Nigeria Breweries are the producers of popular beer drinks including; Star Lager, Gulder, Legend Extra Stout, Heineken, Goldberg, Life, and Star Radler, amongst others.

They are also the producers of alcoholic-free drinks like Maltina, Amstel Malta, Fayrouz, Climax Energy drink, and Malta Gold.

While appreciating its partners, Lawal said, “In appreciation of our great partnership and your commitment, we will deliver at current prices all open orders that are fully funded and created in our system before 00.00hr on Thursday 10th August 2023.”

With inflation reaching 22.79 percent in June and the managed float of the forex market leading to the naira exchanging for as high as N869/$ at the I&E window last Thursday, companies like NB PLC have faced significant challenges.

In their half-year financial results, Nigerian Breweries reported N70.6 billion in forex losses as of 30 June 2023. Coupled with rising production costs and the ever-increasing cost of raw materials, this has created a challenging financial environment for the brewing giant.

Nigeria Breweries, a subsidiary of Heineken NV, experienced a loss of N10.715 billion in the first quarter of 2023, compared to a profit of N13.61 billion in the first quarter of 2022 while International Brewery recorded a loss of N2.31 billion in the first quarter of 2023, contrasting with N0.72 billion in first quarter 2022.

Eighteen-Eleven Media