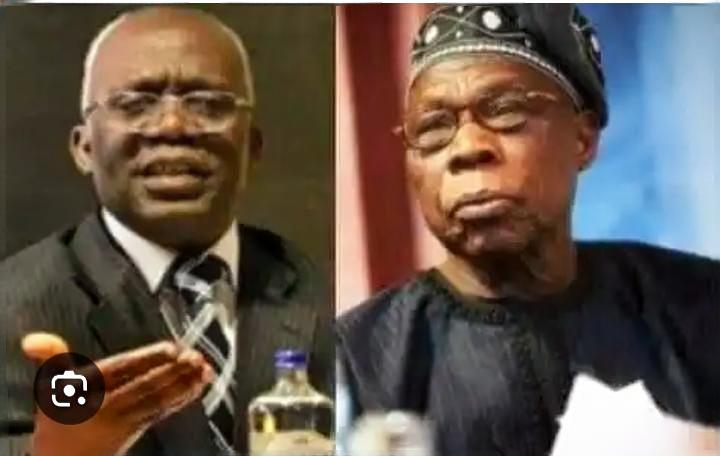

IN a recently released video on Symfoni TV, Mr Femi Falana, a Nigerian human rights lawyer and Senior Advocate of Nigeria (SAN), has brought to light serious allegations concerning the involvement of former President Olusegun Obasanjo in the controversial sale of the Transcorp Hilton Hotel.

Falana has accused Obasanjo of leveraging his position while in office to facilitate the sale of the hotel to a consortium in which he allegedly held a significant stake, thereby effectively transferring ownership to himself.

This revelation has raised significant questions about the ethical and legal dimensions of the transaction.

Falana’s allegations are centred on the privatization processes that were conducted during the final days of the Obasanjo administration. He pointed out that, according to the Privatization and Commercialization Act, the Vice President of Nigeria is legally mandated to serve as the chairman of the National Council on Privatization (NCP), the body responsible for overseeing the privatization of public enterprises.

However, Falana claims that Obasanjo deliberately bypassed this legal requirement by excluding then-Vice President Atiku Abubakar from the process and personally taking charge of the privatization of several state-owned assets.

“In clear violation of the Privatization and Commercialization Act, President Olusegun Obasanjo sidelined Vice President Atiku Abubakar and assumed direct control over the privatization of multiple public enterprises,” Falana asserted.

He further alleged that prior to the sale, Obasanjo had acquired substantial shares in Transcorp through a ‘blind trust,’ a move that has raised serious concerns about the legality and ethical integrity of the entire transaction.

The sale of the Transcorp Hilton Hotel was part of a larger privatization initiative that involved the divestment of key national assets. Falana highlighted that on 17 May 2007, President Obasanjo approved the sale of a 51% stake in the Port Harcourt Refinery to Bluestar Oil for $561 million. Shortly thereafter, on 28 May 2007, a 51% stake in the Kaduna Refinery was also sold to the same consortium for $160 million. Bluestar Oil was a consortium that included prominent Nigerian companies such as Dangote Oil, Zenon Oil and Transcorp.

These transactions drew widespread criticism from various stakeholders, including the National Union of Petroleum and Natural Gas Workers (NUPENG) and the Petroleum and Natural Gas Senior Staff Association of Nigeria (PENGASSAN).

The unions vehemently opposed the sales, arguing that the nation had been severely shortchanged in the deals. They pointed out that the 51% stake in the Port Harcourt Refinery, which was sold for $561 million, had an actual market value of approximately $5 billion. The unions’ protests escalated into a four-day nationwide strike in June 2007, which nearly paralyzed the Nigerian economy.

In response to the public outcry and following a comprehensive review of the transactions, President Umaru Yar’Adua, who succeeded Obasanjo, annulled the privatization of both the Port Harcourt and Kaduna refineries. Falana emphasized that this decision was never legally challenged, as the sales had clearly violated both the letter and the spirit of the Privatization and Commercialization Act.

These revelations have reignited debates about the transparency and integrity of Nigeria’s privatization processes during the Obasanjo era. There are now renewed calls for a thorough investigation into the transactions that were executed in the final days of his administration, with many demanding accountability and a reassessment of the privatization framework to prevent similar occurrences in the future.

The allegations have also sparked broader discussions about the need for stronger governance mechanisms to ensure that public assets are managed in a manner that prioritizes national interest over personal gain.

Eighteen-Eleven Media