Mobolaji Michael

MR ISMAILA DARAMOLA until 21st March 2023 had no qualms giving out his United Bank for Africa (UBA) Plc account details to Grailland for the purpose of payment of an initial deposit for a construction project he was awarded. Had he the premonition of what awaited him, he might probably tow a different path, as that simple act has marked a turning point in his not-too-eventful life.

What was a source of joy for his impecunious family, within a twinkling of an eye, turned to an unmitigated sorrow leading to detention at a police station and further descent to the absy of poverty.

According to counsel to Mr Daramola, Omolade Yusuf (Mrs) of Rosebud Legal Services, his pathetic story started when a total sum of Four Hundred and Eighty Thousand Naira (N480,000.00) deposited into his UBA account number 2279800934 domiciled at Alagbole, Ifo Local Government Area, Ogun State branch of the bank simply vanished after he made a call to the bank’s customer care representative on a dedicated line provided by the bank.

In a petition dated 17th May 2023, addressed to the Branch Manager, Alagbole branch of UBA titled “Unauthorised Transaction On Account Number: Letter Of Demand For Immediate Refund Of Stolen Funds”, Barrister Yusuf explained that her client on 21st March 2023, received the said sum in two instalments of Four Hundred and Fifty Thousand Naira (N450,000.00) on 21st March 2023 and Thirty Thousand Naira (N30,000.00) a day later from his client (Grailland). The said sum was deposited into the above-mentioned account number. She claimed that the fund was meant for the purchase of some construction materials to enable her client to commence work.

However, due to the low-grade status of Mr Daramola’s account, he was said to be unable to make any withdrawal from a Point of Sale (POS) when he attempted to make purchases on Wednesday, the 22nd of March 2023. Mr Daramola was reportedly advised to contact the customer care department of the bank for an upgrade of the said account.

With assistance from a neighbour, he was able to source UBA’s customer care centre number. So between the hours of 10 to 11 am on Tuesday 22nd March 2023, he put a call through to UBA Customer Care Department on 23412808822.

According to Barrister Yusuf, a UBA Customer Care Representative (a lady) who attended to Mr Daramola, contrary to the dictate of professional conduct, and taking advantage of her client’s low level of education, enquired from him his account details including his Automatic Teller Machine (ATM) card password, the 16 digits on the card, vital pieces of information he ignorantly supplied to the UBA customer care representative.

After allegedly appropriating these pieces of information from Mr Daramola, a UBA customer care representative reportedly told Mr Daramola that he would no longer be able to use his account number 2279800934, but that a new account will be opened for him into which the fund will be transferred and from which he could make withdrawals.

Shortly after the interaction with the customer care representative, Mr Datamola received a notification of a new account number namely 2299120632, with his name, sent using the UBA notification number. Barrister Yusuf insisted that this was done without her client’s consent nor was he ever present in any branch of the UBA for that purpose.

“By the following day,23rd of March, he went back to the Alagbole branch of the bank and was able to upgrade the account. At this point, it was confirmed to him by the teller who attended to him that the money was still in his account and that his account is now functioning so he could withdraw his money.

“Our client avers that since he had no use for the money at the time, he decided to withdraw later.

However, our client avers that upon getting home a few hours later, much to his shock, he received a debit alert of N100,000, and thereafter almost immediately, received three more debit alerts of N100,000 each and lastly a debit alert of N80,000 making a total of N480,000 which makes up the entire sum sent to him by his client.

“Prior to the above fraudulent withdrawals, our client recalls that the customer care representative that spoke with him on Wednesday (22nd of March) had informed him that she would open another account for him in his name with account number 2299120632 on the premise that he could no longer use the old account due to the reason that he had to upgrade it.

“Further to the above, our client states that the said customer care representative told him that the money would be transferred into the new account and that was the account that he would be operating from henceforth.

“Our client avers that he received the details of the new account number on that same day, Wednesday the 22nd of March 2023 from the customer care officer on the same customer care line he had earlier spoken to the customer care officer on.”

What happened thereafter was that Mr Daramola received five debit alerts (in multiple of hundred thousand naira each and later eighty thousand naira) indicating that the said money has been withdrawn. He wasn’t still suspicious not until the following day when he approached UBA for withdrawal that the stack reality dawned on him as he was told that there was no credit balance on the account.

Eighteen-Eleven Media reports that the money was moved into an eNaira account. This is deducible from the statement of account made available to Mr Daramola by UBA, a copy of which is in possession of this medium.

He was devastated! His world came crashing! Between then and now, he has been detained at a police facility, tortured, his family turned apart, all courtesy of the alleged sharp practice of staff(s) of UBA.

The petition further pointed out that: “Our client further avers that because he was unable to execute the project, he was arrested and detained by the police upon the request of his client causing him severe trauma and to lose goodwill with the client and his reputation in general.

“Our client avers that ever since he reported this fraudulent incident to your bank, you have failed to investigate and refund his stolen money back to him.

“As solicitors to our client, we are nothing short of shocked and outraged by this entire scenario which shows that you have no idea of the legal consequences of your actions.

“We are also highly perplexed as to how a seemingly reputable bank such as yours will choose to attempt to dump the liability in this case on our client’s feet when it is quite glaring that some of your employees are in cahoots to steal customers’ funds.

“From the facts of the case above and the way your bank has responded to this very grave and fraudulent incident, it is quite clear that you have failed in the duty of care owed to our client. First and most, the following questions beg for answers:”.

Barrister Yusuf, in the petition, thereafter posts the following queries. “If indeed it is the policy of the bank not to ask for sensitive account information from the customers, then why did the customer care agent ask our client for his PIN and other sensitive account information in the course of her official duties as an employee of your bank?

“Why did the same customer care representative, who spoke to our client on Wednesday, the 22nd of March 2023 on the bank’s customer care line being 23412808822, offer to create a new account for our client which she eventually did without him being physically present at the bank for that purpose, providing his signature or providing any form of express authorisation whatsoever?

“Why is your bank reluctant to actively investigate this incident considering all the information at your disposal as a bank particularly the telephone recording of the conversation our client had with the said customer care agent and all the information contained therein?

Barrister Yusuf, therefore, demanded the refund of the said Four Hundred and Eighty Thousand Naira (N480,000.00) as well as the payment of Five Million Naira (N5,000,000.00) for the shock, severe emotional trauma, distress, harassment and subsequent detention over Mr Daramola’s inability to execute the project for which the said money was paid.

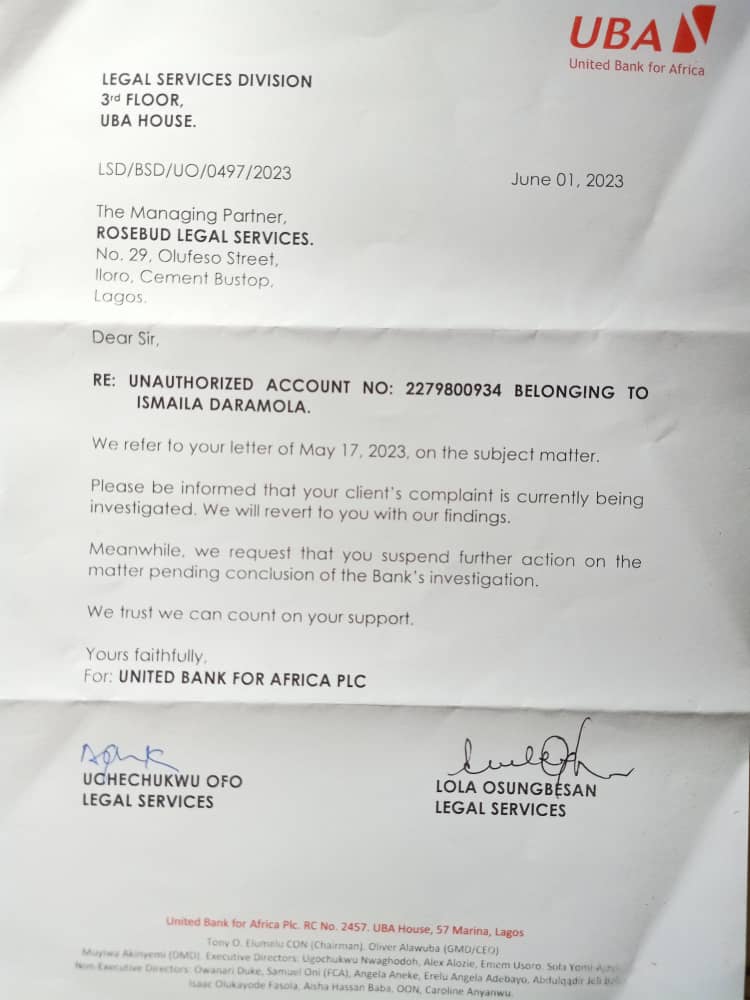

However, in a response by the bank to the petition dated 1st June 2023, UBA pointed out that the issue was being investigated. The letter was signed by Uchechukwu Ofo and Lola Osungbesan.

It reads:

Dear Sir,

RE: UNAUTHORIZED ACCOUNT NO: 2279800934 BELONGING TO ISMAILA DARAMOLA.

We refer to your letter of May 17, 2023, on the subject matter.

Please, be informed that your client’s complaint is currently being investigated. We will revert to yoU with our findings.

Meanwhile, we request that yoU SUspend further action on the matter pending the conclusion of the Bank’s investigation.

We trust we can count on your support.

Yours faithfully,

For: United Bank for Africa

Meanwhile, speaking with Eighteen-Eleven Media on the issue, the spokesperson of the bank, Mr Abiodun Coker, during a phone call with our correspondent on 4th July 2023 admitted it was a case of compromise (though didn’t say by who) and promised that the bank would reverse the transaction. But Barrister Yusuf insists it is the stock in trade of the bank often employ to stall accountability for wrongdoing. “It’s been about a month since the bank’s spokesman said that, and about two months since the bank asked for time to investigate yet nothing has been done to date. Should my client wait in perpetuity? It is their style, hoping that it will be forgotten with time. They have applied that method in a number of instances, but it won’t work this time around.

Eighteen-Eleven Media