THE Arewa Youth Consultative Forum (AYCF) has accused the Group Chief Executive Officer of Guaranty Trust Holding Company (GTCO), Segun Agbaje, of orchestrating the arrests of activists critical of the bank’s operations.

The group called on the Inspector-General of Police to release the detained individuals and initiate an investigation into Agbaje’s alleged actions.

AYC’Fs accusation is coming on the heels of condemnation from the Nigerian Guild of Investigative Journalists (NGIJ) over what it described as a display of ‘corporate intimidation’.

The Guild denounced GTCO’s alleged attempt to silence the media, citing the recent arrest of journalist Olurotimi Olawale, who had been reporting on the bank’s activities.

In a statement signed by NGIJ President, Abdulrahman Aliagan and Secretary Rowland Olonishuwa, the Guild expressed concern over the growing trend of stifling press freedom. They highlighted that Olawale’s arrest is the latest instance of the bank’s efforts to muzzle the media.

Reacting to the situation, AYCF President Yusuf Kabiru, who has already petitioned the House of Representatives on alleged fictitious profit reporting by GTCO and other issues, urged Agbaje to stop harassing those who criticise him.

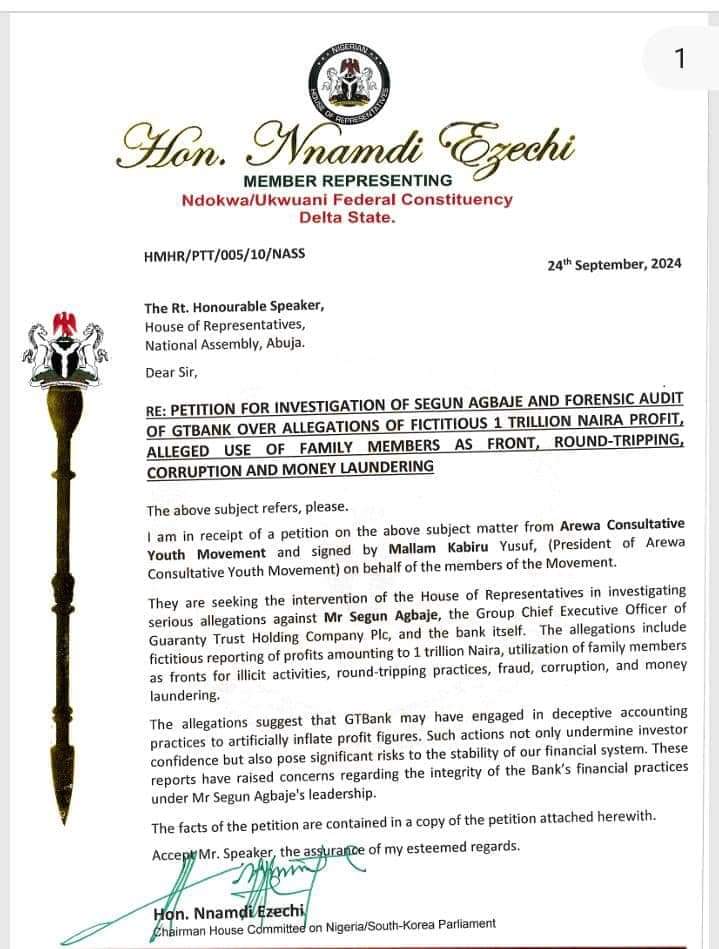

A member of the House of Representatives, Nnamdi Ezechi, in a letter to the Speaker of the House of Representatives, Tajudeen Abbas, confirmed the receipt of the petition against Agbaje.

Kabiru has, however, warned that the alleged continued harassment of activists by Agbaje could escalate the crisis.

He said, “We are shocked and highly disappointed by the alleged disturbing and undemocratic trend by Guaranty Trust and its CEO, Segun Agbaje, who is allegedly trying to muscle the press and gag their freedom by arresting anyone who criticises their activities.

“Mr Segun Agbaje, the Group Chief Executive Officer of Guaranty Trust Holding Company Plc, should understand that no one is above the law, and if some citizens and customers are concerned by your activities, they have the right to. While we urge the Inspector General of Police (IGP) to release the detained activists and journalists, we have also already petitioned the House of Representatives to look into the corruption and money laundering allegations against the bank.

“We are urging the police to thoroughly investigate the allegations, including fictitious reporting of profits amounting to 1 trillion Naira, utilisation of family members as fronts for illicit activities, round-tripping practices, fraud, corruption, and money laundering. The allegations suggest that GTBank may have engaged in deceptive accounting practices to artificially inflate profit figures. Such actions not only undermine investor confidence but also pose significant risks to the stability of our financial system.

“Fictitious Profit Reporting: It has come to light that GTBank may have reported profits that do not reflect its actual financial performance. Specifically, claims indicate that the bank reported a profit exceeding 1 trillion Naira without substantial evidence supporting such figures.

“Use of Family Members as Fronts: Credible reports suggest that Mr Agbaje has utilised family members as fronts in various business dealings related to GTBank. This practice raises ethical concerns about conflicts of interest and transparency within the bank’s operations.

“Round-Tripping Activities: Allegations have surfaced regarding round-tripping—where funds are moved in and out through different accounts or entities to create an illusion of legitimate transactions. This practice is often associated with money laundering and other fraudulent activities.

“The combination of inflated profit reporting and unethical business practices points towards systemic issues within GTBank that could be indicative of broader fraud and corruption. Given the scale of these allegations, there is an urgent need for scrutiny regarding potential money laundering activities facilitated by GTBank’s operations. We are only demanding greater accountability from corporate entities and safeguard the rights of citizens.”

Eighteen-Eleven Media